We offer a free no obligation consultation for any of your legal needs. If you need immediate results and help we are the firm to call. Please enjoy some of our stories of some legal issues today! We will be there to guide you and advocate for you during some of the most difficult times.

Thursday, February 26, 2015

Ketoconazole-Anti Fungal Medication Should Not Be Distributed

Heritage Pharmaceuticals Doing The Right Thing--

Heritage Pharmaceuticals has initiated a nationwide voluntary

recall of ten lots of colistimethate for injection (150 mg) and

three lots of rifampin for injection (600 mg) because of

concerns over lack of sterility.

Colistimethate is indicated for the treatment of acute or

chronic infections due to sensitive strains of certain gram-

negative bacteria.

Rifampin is indicated for the treatment of all forms of

tuberculosis.The recalled colistimethate has national drug code

(NDC) 23155-193-31, and the recalled rifampin has NDC

23155-340-31.

Both products are sold in single-vial monocartons in case packs

of ten. The recall (to the user level) stems from observations by

the US Food and Drug Administration (FDA) regarding aseptic

and general manufacturing practices at the manufacturer's site

potentially affecting product sterility, according to a company

news release posted on the FDA website. "Intravenous

administration of nonsterile injection products to a normally

sterile site may result in a site-specific or systemic infection,

which in turn may cause hospitalization, significant morbidity

(permanent organ damage), or fatal outcome. To date, Heritage

is not aware of any adverse patient events resulting from the

use of the subject product lots," the release says.

The recalled products were distributed to hospitals, wholesalers, and distributors nationwide from December 2012 through January 2015 for colistimethate and from October 2014 through January 2015 for rifampin.

Customers are being notified by fax, email, United Parcel Service, and/or certified mail to return all recalled product.

Heritage asks all customers to check their inventory "immediately and to quarantine, discontinue distribution of, and return the recalled lots of product. Customers who may have further distributed these products have been requested to identify their customers and notify them at once of this product recall."

Questions regarding this recall can be directed to the customer call center at (866) 901-1230 Monday through Friday from 9:00 am to 5:00 pm Eastern Standard Time.

Adverse reactions or quality problems experienced with the use of these products should be reported to MedWatch, the FDA's safety information and adverse event reporting program, by telephone at 1-800-FDA-1088; by fax at 1-800-FDA-0178; online at https://www.accessdata.fda.gov/scripts/medwatch/medwatch- online.htm; with postage-paid FDA form 3500, available at http://www.fda.gov/MedWatch/getforms.htm; or by mail to MedWatch, 5600 Fishers Lane, Rockville, Maryland 20852-9787.

Tuesday, February 24, 2015

Whistblower Being Wronged For Doing Right!

Thomas Drake became a symbol of the dangers whistleblowers

face when they help journalists and Congress investigate

wrongdoing at intelligence agencies. He claims he was subjected to

a decade of retaliation by the National Security Agency that

culminated in his being charged with espionage.

But when the Pentagon Inspector General’s Office opened an

inquiry into the former senior NSA official’s allegations of

retaliation in 2012, it looked at only two of the 10 years detailed in

his account, according to a recently released Pentagon summary of

the probe, before finding no evidence of retaliation. That finding

ended Drake’s four-year effort to return to government service.

Whistleblower advocates say Drake’s experience, spelled out in a

document McClatchy obtained this month through the Freedom of I

information Act, underscores the problem that intelligence and

defense workers face in bringing malfeasance to the surface. The

agencies that are supposed to crack down on retaliation are not up

to the task, especially when the alleged wrongdoing involves

classified information, they charge.

“This report epitomizes the utter lack of protection for national

security whistleblowers,” said Jesselyn Radack, Drake’s attorney.

“This is a pathetic, anemic excuse for an investigation.”

Although investigators appear to have rejected Drake’s claims

almost a year ago, the Pentagon Inspector General’s Office did not

publicly disclose its findings and hadn’t shared them even with

Drake’s attorneys. McClatchy gave the attorneys a copy of the

report.

The news of the rejection comes as McClatchy has learned that the

same officials who are supposed to be helping whistleblowers such

as Drake claim that they themselves have been forced to blow the

whistle on their own office.

Multiple former and current officials from the Pentagon Inspector

General’s Office have alleged to the Office of Special Counsel, the

independent government agency that investigates whistleblower

claims, that they’ve been retaliated against for objecting to how

cases are handled. Drake’s case is one of several singled out for

criticism.

“It illustrates the bleak landscape faced by whistleblowers and IG investigators,” said one of the several people who described the accusations but asked to remain anonymous because of the sensitivity of the matter. “The numerous allegations of reprisal and misconduct directed against senior IG officials call into question the efficacy of the whistleblower mission. If true, one can make the case that the office of inspector general has failed.”

Read more here: http://www.charlotteobserver.com/2015/02/23/5534356/rejection-of-nsa-whistleblowers.html#storylink=cpy

Western Health Fraudulantly Taking Your Health Treatment Into Their Bank Account!

“In a remarkable investigation, CBS News correspondent Jim

Axelrod and producer Emily Rand have discovered that

unwitting patients across the country were sent millions of

dollars in medications they did not order.” The drugs are

“made by compounding pharmacies which mix custom drugs

for” physicians, but in this case, “the combination of the

compounding pharmacy with a telemarketer added up to

outrageous bills to Medicare and private insurance.” In the

specific case of a couple interviewed by CBS, “their insurance

had been billed, $2,500 for a pain cream, $3,600 for a migraine

cream and nearly $13,000 for a scar gel.” The investigation

learned that the medicines were pitched by Western Medical

“as a free benefit paid by insurance,” and if a patient expressed

interest Western Medical “sent over pre-written prescriptions

for the doctor to sign.”

Monday, February 23, 2015

Unsafe and Contaminated Medications Released To American's

The Brooklyn (NY) Daily Eagle reported that “the federal

government” has “unsealed a 37-count indictment

charging Med Prep Consulting Inc. with wire fraud and

violations of the Federal Food, Drug and Cosmetic Act

(FDCA).” The company, “together with its owner and

president, Gerald Tighe, and pharmacist-in-charge,

Stephen Kalinoski, allegedly introduced adulterated and

misbranded drugs into the commerce stream and

misbranded drugs with the intent to defraud and mislead

the US Food and Drug Administration (FDA) and Med

Prep’s customers, who consisted of hospitals and other

healthcare providers.” The Daily Eagle added,

“According to the indictment, Med Prep processed

numerous drugs...in purportedly sterile conditions. In an

effort to gain market share, Med Prep repeatedly

misrepresented to its healthcare provider customers that

it adhered to, and in some areas exceeded, industry

standards and laws applicable to sterile drug

preparation.” FDA Commissioner Hamburg said, “The

production of unsafe and contaminated drug products

poses a serious threat to the health of the American

public and cannot be tolerated.”

Tuesday, February 17, 2015

Stryker Hip Settlement Over $1 Billion

Stryker has agreed to pay over $1 billion to the thousands of plaintiffs involved in Stryker hip recall lawsuits. These metal on metal hip implant lawsuits were filed after Stryker’s metal-on-metal hip implants failed in thousands of patients which led to the Stryker recall. Stryker, and other makers of metal-on-metal hip implants, have faced countless hip replacement lawsuits concerning serious hip replacement complications.

Nearly 4,500 Stryker hip recall lawsuits have been filed concerning the Stryker Rejuvenate Hip Stem and ABG II devices. They have been consolidated into two Stryker recall MDLs, one in a Minnesota federal court with 2,271 Stryker metal hip lawsuits and the other in the Bergen County Superior Court in New Jersey, with 2,160 hip replacement lawsuits.

The Stryker hip recall was issued in 2012 after the metal-on-metal hip implants were failing in patients across the country. The Stryker metal-on-metal hip implants caused many patients to experience hip replacement complications such as failed implants, swelling, metal poisoning (caused by metal particles being released into the blood stream), and others. Many have had to undergo hip revision surgery in order to manage the metal hip implant side effects caused by the Stryker hip.

After many Stryker hip recall lawsuits had been filed, a settlement program was announced in November 2014 that stated each victim could receive $300,000 for hip replacement complications. This number was subject to increase or decrease depending on the individual, including any complications or additional needs for hip revision surgery. Plaintiffs who required multiple surgeries because of hip replacement complications will most likely receive a larger award.

Sunday, February 15, 2015

Mortgage Fraud Righted Against Our Veterans

Service Members to Receive Over $123 Million for Unlawful Foreclosures Under the Servicemembers Civil Relief Act

The Justice Department announced today that under its settlements with five of the nation’s largest mortgage servicers, 952 service members and their co-borrowers are eligible to receive over $123 million for non-judicial foreclosures that violated the Servicemembers Civil Relief Act. The five mortgage servicers are JP Morgan Chase Bank N.A. (JP Morgan Chase); Wells Fargo Bank N.A. and Wells Fargo & Co. (Wells Fargo); Citi Residential Lending Inc., Citibank, NA and CitiMortgage Inc. (Citi); GMAC Mortgage, LLC, Ally Financial Inc. and Residential Capital LLC (GMAC Mortgage); and BAC Home Loans Servicing LP formerly known as Countrywide Home Loans Servicing LP (Bank of America).

In the first round of payments under the SCRA portion of the 2012 settlement known as the National Mortgage Settlement (NMS), 666 service members and their co-borrowers will receive over $88 million from JP Morgan Chase, Wells Fargo, Citi and GMAC Mortgage. The other 286 service members and their co-borrowers already have received over $35 million from Bank of America through an earlier settlement. The non-judicial foreclosures at issue took place between Jan. 1, 2006, and Apr. 4, 2012.

“These unlawful judicial foreclosures forced hundreds of service members and their families out of their homes,” said Acting Associate Attorney General Stuart F. Delery. “While this compensation will provide a measure of relief, the fact is that service members should never have to worry about losing their home to an illegal foreclosure while they are serving our country. The department will continue to actively protect our service members and their families from such unjust actions.”

“We are very pleased that the men and women of the armed forces who were subjected to unlawful non-judicial foreclosures while they were serving our country are now receiving compensation,” said Acting Assistant Attorney General Vanita Gupta of the Civil Rights Division. “We look forward, in the coming months, to facilitating the compensation of additional service members who were subjected to unlawful judicial foreclosures or excess interest charges. We appreciate that JP Morgan Chase, Wells Fargo, Citi, GMAC Mortgage and Bank of America have been working cooperatively with the Justice Department to compensate the service members whose rights were violated.”

Section 533 of the SCRA prohibits non-judicial foreclosures against service members who are in military service or within the applicable post-service period, as long as they originated their mortgages before their period of military service began. Even in states that normally allow mortgage foreclosures to proceed non-judicially, the SCRA prohibits servicers from doing so against protected service members during their military service and applicable post-military service coverage period.

Under the NMS, for mortgages serviced by Wells Fargo, Citi and GMAC Mortgage, the identified service members will each receive $125,000, plus any lost equity in the property and interest on that equity. Eligible co-borrowers will also be compensated for their share of any lost equity in the property. To ensure consistency with an earlier private settlement, JP Morgan Chase will provide any identified service member either the property free and clear of any debt or the cash equivalent of the full value of the home at the time of sale, and the opportunity to submit a claim for compensation for any additional harm suffered, which will be determined by a special consultant, retired U.S. District Court Judge Edward N. Cahn. Payment amounts have been reduced for those service members or co-borrowers who have previously received compensation directly from the servicer or through a prior settlement, such as the independent foreclosure review conducted by the Office of the Comptroller of the Currency and the Federal Reserve Board. The Bank of America payments to identified service members with nonjudicial foreclosures were made under a 2011 settlement with the Department of Justice.

Borrowers should use the following contact information for questions about SCRA payments under the National Mortgage Settlement:

Today’s settlement was announced in connection with the President’s Financial Fraud Enforcement Task Force. The task force was established to wage an aggressive, coordinated and proactive effort to investigate and prosecute financial crimes. With more than 20 federal agencies, 94 U.S. Attorneys’ Offices and state and local partners, it is the broadest coalition of law enforcement, investigatory and regulatory agencies ever assembled to combat fraud. Since its formation, the task force has made great strides in facilitating increased investigation and prosecution of financial crimes, enhancing coordination and cooperation among federal, state and local authorities, addressing discrimination in the lending and financial markets and conducting outreach to the public, victims, financial institutions and other organizations. Over the past three fiscal years, the Justice Department has filed nearly 10,000 financial fraud cases against nearly 15,000 defendants including more than 2,900 mortgage fraud defendants. For more information on the task force, please visit www.StopFraud.gov.

In the first round of payments under the SCRA portion of the 2012 settlement known as the National Mortgage Settlement (NMS), 666 service members and their co-borrowers will receive over $88 million from JP Morgan Chase, Wells Fargo, Citi and GMAC Mortgage. The other 286 service members and their co-borrowers already have received over $35 million from Bank of America through an earlier settlement. The non-judicial foreclosures at issue took place between Jan. 1, 2006, and Apr. 4, 2012.

“These unlawful judicial foreclosures forced hundreds of service members and their families out of their homes,” said Acting Associate Attorney General Stuart F. Delery. “While this compensation will provide a measure of relief, the fact is that service members should never have to worry about losing their home to an illegal foreclosure while they are serving our country. The department will continue to actively protect our service members and their families from such unjust actions.”

“We are very pleased that the men and women of the armed forces who were subjected to unlawful non-judicial foreclosures while they were serving our country are now receiving compensation,” said Acting Assistant Attorney General Vanita Gupta of the Civil Rights Division. “We look forward, in the coming months, to facilitating the compensation of additional service members who were subjected to unlawful judicial foreclosures or excess interest charges. We appreciate that JP Morgan Chase, Wells Fargo, Citi, GMAC Mortgage and Bank of America have been working cooperatively with the Justice Department to compensate the service members whose rights were violated.”

Section 533 of the SCRA prohibits non-judicial foreclosures against service members who are in military service or within the applicable post-service period, as long as they originated their mortgages before their period of military service began. Even in states that normally allow mortgage foreclosures to proceed non-judicially, the SCRA prohibits servicers from doing so against protected service members during their military service and applicable post-military service coverage period.

Under the NMS, for mortgages serviced by Wells Fargo, Citi and GMAC Mortgage, the identified service members will each receive $125,000, plus any lost equity in the property and interest on that equity. Eligible co-borrowers will also be compensated for their share of any lost equity in the property. To ensure consistency with an earlier private settlement, JP Morgan Chase will provide any identified service member either the property free and clear of any debt or the cash equivalent of the full value of the home at the time of sale, and the opportunity to submit a claim for compensation for any additional harm suffered, which will be determined by a special consultant, retired U.S. District Court Judge Edward N. Cahn. Payment amounts have been reduced for those service members or co-borrowers who have previously received compensation directly from the servicer or through a prior settlement, such as the independent foreclosure review conducted by the Office of the Comptroller of the Currency and the Federal Reserve Board. The Bank of America payments to identified service members with nonjudicial foreclosures were made under a 2011 settlement with the Department of Justice.

Borrowers should use the following contact information for questions about SCRA payments under the National Mortgage Settlement:

- Bank of America borrowers should call Rust Consulting, Inc., the settlement administrator, toll-free at 1-855-793-1370 or write to BAC Home Loans Servicing Settlement Administrator, c/o Rust Consulting, Inc., P.O. Box 1948, Faribault, MN 55021-6091.

- Citi borrowers should call Citi toll-free at 1-888-326-1166.

- GMAC Mortgage borrowers should call Rust Consulting Inc., the settlement administrator, toll-free at 1-866-708-0915 or write to P.O. Box 3061, Faribault, Minnesota 55021-2661.

- JPMorgan Chase borrowers should call Chase toll-free at 1-877-469-0110 or write to P.O. Box 183224, OH-7160/DOJ, Columbus, Ohio 43219-6009.

- Wells Fargo borrowers should call the Wells Fargo Home Mortgage Military Customer Service Center toll free at 1-877-839-2359.

Today’s settlement was announced in connection with the President’s Financial Fraud Enforcement Task Force. The task force was established to wage an aggressive, coordinated and proactive effort to investigate and prosecute financial crimes. With more than 20 federal agencies, 94 U.S. Attorneys’ Offices and state and local partners, it is the broadest coalition of law enforcement, investigatory and regulatory agencies ever assembled to combat fraud. Since its formation, the task force has made great strides in facilitating increased investigation and prosecution of financial crimes, enhancing coordination and cooperation among federal, state and local authorities, addressing discrimination in the lending and financial markets and conducting outreach to the public, victims, financial institutions and other organizations. Over the past three fiscal years, the Justice Department has filed nearly 10,000 financial fraud cases against nearly 15,000 defendants including more than 2,900 mortgage fraud defendants. For more information on the task force, please visit www.StopFraud.gov.

Tuesday, February 10, 2015

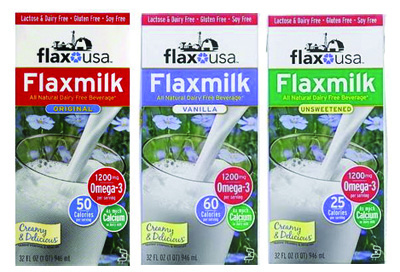

Flaxmilk False Advertising Claim. Are You Entitled To A Refund?

Flax USA Inc. has reached a class action lawsuit settlement over claims it deceptively labeled its flax milk products as “All Natural.” If you purchased flax milk sold by Flax USA in the United States between Nov. 5, 2009 and Sept. 22, 2014, you may be eligible to claim up to $32.50 from the Flax USA flax milk class action settlement.

The flax milk settlement resolves a class action lawsuit (Madenlian v. Flax USA) that claims consumers were misled into purchasing Flax USA flax milk products based on the misleading statement: “All Natural Dairy Free Beverage.”

Plaintiffs allege the statement is misleading because the products contain the following artificial or synthetic ingredients: Tricalcium Phosphate, Xanthan Gum, Vitamin A Palmitate, Vitamin D2, and Vitamin B12. Had they known Flax USA flax milk products contained these allegedly artificial or synthetic ingredients, they would not have purchased the products, the flax milk class action lawsuit claims.

Flax USA denies the allegations and contends that the statements “All Natural Dairy Free Beverage* / *Added Vitamins & Minerals,” read in combination, do no not represent that the added vitamins and minerals are “all natural.” However, the company has agreed to establish a $260,000 class action settlement fund to avoid the uncertainty of going to trial.

Class Members of the Flax USA flax milk settlement include all persons in the United States who purchased any of the following products from Nov. 5, 2009 to Sept. 22, 2014:

Flax USA Flax Milk Original

Flax USA Flax Milk Unsweetened

Flax USA Flax Milk Vanilla

The products must be aseptic (i.e., shelf-stable, non-refrigerated) flax milk sold in 32-oz size cartons.

Potential Award

$2.50 – $32.50 depending on how many Flax USA flax milk products you purchased and which of the following levels you fall under:

Lower Level: You may seek reimbursement of $2.50 per carton purchased (up to a maximum of 10 cartons per claimant or address) without identifying the retailer or the retailer’s location where you purchased the product(s).

Higher Level: You may seek reimbursement of $3.25 per carton purchased (up to a maximum of 10 cartons per claimant or address) if you can indicate on the Claim Form both (1) the name of the retailer where you purchased the flax milk and (2) the city and state where that retailer is located.

The amount of money you receive from the Flax USA flax milk class action settlement may be reduced pro rata if the total number of valid claims exceeds the $260,000 settlement fund.

Proof of Purchase

You do not have to provide proof of purchase if you are claiming products under the “Lower Level” tier. However, you must provide the name of the retailer and the retailer’s location if you are submitting a claim under the “Higher Level.” Please see details above under “Potential Award.”

Claim Form

CLICK HERE TO FILE A CLAIM »

Claim Form Deadline

04/28/15

Saturday, February 7, 2015

MN Medtronic's Device Untested Yet Still Released! What Do You Do When You Can't Trust Your Dr.?

Medical device manufacturer Medtronic Inc. has agreed to pay the United States $2.8 million to resolve allegations under the False Claims Act that Medtronic caused certain physicians to submit false claims to federal health care programs for a medical procedure known as “SubQ stimulation,” the Justice Department announced today. Medtronic Inc. is a medical technology company based in Minnesota.

“Today’s settlement demonstrates our commitment to ensure that beneficiaries of federal health care plans, including Medicare recipients and military families, receive medical treatments that have been proven safe and effective,” said Acting Assistant Attorney General Joyce R. Branda of the Justice Department’s Civil Division. “Targeting chronic pain patients with a medical procedure that lacks evidence of clinical efficacy wastes the country’s health care resources.”

The United States alleged that from 2007 through 2011, Medtronic knowingly caused dozens of physicians located throughout more than 20 states to submit claims to Medicare and TRICARE for investigational medical procedures known as SubQ stimulation that were not reimbursable. In these procedures, Medtronic’s spinal cord stimulation devices were placed just beneath the skin near an area of pain, most often in the lower back, where the devices could provide electrical impulses to create a “tingling” sensation intended to alleviate chronic pain. The United States alleged that even though the safety and efficacy of SubQ stimulation had not been established as required by the Food and Drug Administration (FDA), the company promoted this procedure by, among other strategies, arranging to have physician-customers attend Medtronic-sponsored “on-site training programs” regarding the use of Medtronic spinal cord stimulation devices for SubQ stimulation.

“Patients should be able to trust that their health care providers only use – and bill Medicare for – medical procedures that have been shown to be safe and effective,” said Special Agent in Charge Scott J. Lampert of the Department of Health and Human Services’ Office of Inspector General. “Our agency will continue to pursue medical device makers that ignore requirements designed to protect patient health and federal health care programs.”

The civil settlement resolves a lawsuit filed under the whistleblower provision of the False Claims Act, which permits private parties to file suit on behalf of the United States for false claims and obtain a portion of the government’s recovery. The lawsuit was filed by Jason Nickell, who formerly worked as a Medtronic sales representative. Nickell will receive $602,000.

This settlement illustrates the government’s emphasis on combating health care fraud and marks another achievement for the Health Care Fraud Prevention and Enforcement Action Team (HEAT) initiative, which was announced in May 2009 by the Attorney General and the Secretary of Health and Human Services. The partnership between the two departments has focused efforts to reduce and prevent Medicare and Medicaid financial fraud through enhanced cooperation. One of the most powerful tools in this effort is the False Claims Act. Since January 2009, the Justice Department has recovered a total of more than $23.5 billion through False Claims Act cases, with more than $15 billion of that amount recovered in cases involving fraud against federal health care programs.

Wednesday, February 4, 2015

Cardinal Health Whistleblower Uncovers Internal Kickback Fraud

The Department of Justice announced last week that Ohio-based pharmaceutical distributor Cardinal Health, Inc. (CAH) will pay the government $8 million to resolve allegations by two whistleblowers that the company paid them kickbacks to buy its drugs.

Whistleblowers R. Daniel Saleaumua, a pharmacy owner, and consultant Kevin Rinne accused Cardinal Health of violating the federal Anti-Kickback Statute after the pharmaceutical wholesaler allegedly paid Saleaumua $440,000 for agreeing to buy its prescription drugs for his pharmacies. Under the False Claims Act, private citizens can sue on behalf of the United States and share in any recovery. Together, Saleaumua and Rinne will receive $760,000 as their share of the governments recovery.

Financial kickbacks, like the ones alleged in the Cardinal Health whistleblower lawsuit, weaken Medicare and Medicaid by steering taxpayer dollars into provider pockets, rather than into sound patient care, said the DOJ.

American taxpayers are the victims of illegal kickback schemes that result in Medicare and Medicaid paying millions of dollars more than they should for prescription drugs,said Beth Phillips, U.S. Attorney for the Western District of Missouri.Todays $8 million settlement underscores our commitment to combating health care fraud and protecting taxpayers.

The Cardinal Health whistleblower settlement is part of the governments emphasis on combating health care fraud and another step for the Health Care Fraud Prevention and Enforcement Action Team (HEAT) initiative, which was announced in May 2009. One of the most powerful tools in that effort is the False Claims Act, which the Justice Department has used to recover more than $5.5 billion since January 2009 in cases involving fraud against federal health care programs.

Tuesday, February 3, 2015

Overseas Fraud Committed by Minebea!

Minebea Co. Ltd., a small sized bearings manufacturer based in Nagano, Japan, has agreed to plead guilty and to pay a $13.5 million criminal fine for its role in a conspiracy to fix prices for small sized ball bearings sold to customers in the United States and elsewhere, the Department of Justice announced today.

According to a one-count felony charge filed today in U.S. District Court for the Southern District of Ohio in Cincinnati, Minebea conspired to fix the prices of small sized ball bearings in the United States and elsewhere. In addition to the criminal fine, Minebea has agreed to cooperate in the department’s ongoing investigation. The plea agreement is subject to court approval.

According to the charge, Minebea and its co-conspirator discussed and agreed upon prices to be submitted to small sized ball bearings customers. Minebea’s participation in the conspiracy lasted from at least as early as early-to-mid 2008 and continued until at least October 2011.

“Any agreement that restricts price competition violates the law,” said U.S. Attorney Carter Stewart of Southern District of Ohio. “We will continue to work to protect consumers’ right to free and open competition.”

Bearings are used in industry in numerous products to reduce friction and help parts roll smoothly past one another; they “bear” the load. Small sized ball bearings are those ball bearings whose outside diameter is 26 millimeters or less.

Minebea is charged with price fixing in violation of the Sherman Act, which carries a maximum penalty of a $100 million criminal fine for corporations. The maximum fine may be increased to twice the gain derived from the crime or twice the loss suffered by the victims of the crime, if either of those amounts is greater than the statutory maximum fine.

According to a one-count felony charge filed today in U.S. District Court for the Southern District of Ohio in Cincinnati, Minebea conspired to fix the prices of small sized ball bearings in the United States and elsewhere. In addition to the criminal fine, Minebea has agreed to cooperate in the department’s ongoing investigation. The plea agreement is subject to court approval.

According to the charge, Minebea and its co-conspirator discussed and agreed upon prices to be submitted to small sized ball bearings customers. Minebea’s participation in the conspiracy lasted from at least as early as early-to-mid 2008 and continued until at least October 2011.

“Any agreement that restricts price competition violates the law,” said U.S. Attorney Carter Stewart of Southern District of Ohio. “We will continue to work to protect consumers’ right to free and open competition.”

Bearings are used in industry in numerous products to reduce friction and help parts roll smoothly past one another; they “bear” the load. Small sized ball bearings are those ball bearings whose outside diameter is 26 millimeters or less.

Minebea is charged with price fixing in violation of the Sherman Act, which carries a maximum penalty of a $100 million criminal fine for corporations. The maximum fine may be increased to twice the gain derived from the crime or twice the loss suffered by the victims of the crime, if either of those amounts is greater than the statutory maximum fine.

Subscribe to:

Posts (Atom)