We offer a free no obligation consultation for any of your legal needs. If you need immediate results and help we are the firm to call. Please enjoy some of our stories of some legal issues today! We will be there to guide you and advocate for you during some of the most difficult times.

Showing posts with label consumers. Show all posts

Showing posts with label consumers. Show all posts

Saturday, October 3, 2015

Friday, June 12, 2015

Trinity Ordered To Pay Settlement Of $663 Million

Joshua Harman, a Virginian with two small highway safety companies, made a discovery in late 2011 that perhaps only a guardrail maker could: A big competitor had changed the dimensions of its roadside safety device by as much as an inch here and there, he said, without telling federal regulators.

As designed, Trinity Industries Inc.’s ET-Plus system was meant to turn the end of a guardrail into a de facto shock absorber. The altered units, as Harman saw it, were locking up when hit, spearing cars and their occupants.

Harman, 46, spent 3 1/2 years trying to prove his point, driving hundreds of thousands of miles to inspect twisted guardrails at crash sites. In 2012 he sued Trinity, accusing it of hiding the potentially deadly alterations from the Federal Highway Administration. On Tuesday, almost eight months after a Texas jury agreed Trinity had defrauded taxpayers, the judge issued a final penalty: Trinity must pay $663 million, with $199 million of that going to Harman and the rest to the government.

It was one of the largest awards to taxpayers under the U.S. False Claims Act as well as the largest to an individual whistle-blower, said Patrick Burns, co-director of the nonprofit group Taxpayers Against Fraud Education Fund.

Harman, who lost his left leg in a construction accident two decades ago, said he brought the case to raise awareness about a safety risk that he says cost many victims their limbs. At least nine deaths have been linked in personal-injury lawsuits to the ET-Plus.

“I have sacrificed everything I’ve got to facilitate this situation,” Harman said. “With this $663 million judgment, it opens the eyes, hopefully, of the nation.”

Harman, whose guardrail manufacturing company filed for bankruptcy protection in March, may never collect on the award if Trinity, the biggest U.S. maker of highway safety equipment, wins on appeal.

Jeff Eller, a spokesman for Dallas-based Trinity, said in an e-mail that “the judgment is erroneous and should be reversed in its entirety.”

Trinity has said the changes didn’t detract from the safety of its ET-Plus units, which have been successfully tested multiple times. The company, whose shares have fallen 18 percent since the verdict, is defending more than 20 lawsuits over the safety of the ET-Plus.

One day after the October verdict, the FHWA, which evaluates highway devices before declaring them eligible for federal reimbursement, ordered a review of the ET-Plus. The system passed all eight crash tests since then, the agency said in March.

Tuesday, February 10, 2015

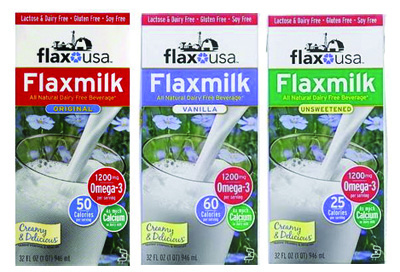

Flaxmilk False Advertising Claim. Are You Entitled To A Refund?

Flax USA Inc. has reached a class action lawsuit settlement over claims it deceptively labeled its flax milk products as “All Natural.” If you purchased flax milk sold by Flax USA in the United States between Nov. 5, 2009 and Sept. 22, 2014, you may be eligible to claim up to $32.50 from the Flax USA flax milk class action settlement.

The flax milk settlement resolves a class action lawsuit (Madenlian v. Flax USA) that claims consumers were misled into purchasing Flax USA flax milk products based on the misleading statement: “All Natural Dairy Free Beverage.”

Plaintiffs allege the statement is misleading because the products contain the following artificial or synthetic ingredients: Tricalcium Phosphate, Xanthan Gum, Vitamin A Palmitate, Vitamin D2, and Vitamin B12. Had they known Flax USA flax milk products contained these allegedly artificial or synthetic ingredients, they would not have purchased the products, the flax milk class action lawsuit claims.

Flax USA denies the allegations and contends that the statements “All Natural Dairy Free Beverage* / *Added Vitamins & Minerals,” read in combination, do no not represent that the added vitamins and minerals are “all natural.” However, the company has agreed to establish a $260,000 class action settlement fund to avoid the uncertainty of going to trial.

Class Members of the Flax USA flax milk settlement include all persons in the United States who purchased any of the following products from Nov. 5, 2009 to Sept. 22, 2014:

Flax USA Flax Milk Original

Flax USA Flax Milk Unsweetened

Flax USA Flax Milk Vanilla

The products must be aseptic (i.e., shelf-stable, non-refrigerated) flax milk sold in 32-oz size cartons.

Potential Award

$2.50 – $32.50 depending on how many Flax USA flax milk products you purchased and which of the following levels you fall under:

Lower Level: You may seek reimbursement of $2.50 per carton purchased (up to a maximum of 10 cartons per claimant or address) without identifying the retailer or the retailer’s location where you purchased the product(s).

Higher Level: You may seek reimbursement of $3.25 per carton purchased (up to a maximum of 10 cartons per claimant or address) if you can indicate on the Claim Form both (1) the name of the retailer where you purchased the flax milk and (2) the city and state where that retailer is located.

The amount of money you receive from the Flax USA flax milk class action settlement may be reduced pro rata if the total number of valid claims exceeds the $260,000 settlement fund.

Proof of Purchase

You do not have to provide proof of purchase if you are claiming products under the “Lower Level” tier. However, you must provide the name of the retailer and the retailer’s location if you are submitting a claim under the “Higher Level.” Please see details above under “Potential Award.”

Claim Form

CLICK HERE TO FILE A CLAIM »

Claim Form Deadline

04/28/15

Tuesday, September 23, 2014

Mortgage Fraud Still Happening

If you thought the bad guys had left the mortgage business for greener pastures, think again. The thieves are still out there, ready to separate you from your money. But at the same time, many of us are still not above stretching the truth a little when we are trying to obtain financing.

First, the business bad guys, represented today by Amerisave Mortgage Corp., which the Consumer Financial Protection Bureau has ordered to pay $19.3 million for providing a deceptive bait-and-switch scheme on would-be borrowers.

The CFPB found that the Atlanta-based online company, which lends in all 50 states, lured consumers by advertising misleading interest rates. Then locked them in with costly up-front fees, failed to honor its published rates and illegally overcharged them for affiliated third-party services.

Here's how it worked, according to the CFPB:

Since 2011, the company advertised inaccurate rates and terms in online banner ads and searchable rate tables on third-party websites, inducing consumers to pursue a mortgage with Amerisave. Once at Amerisave's website, consumers received quotes based on an 800 FICO score, even when they had previously entered a score well below 800 on the third-party site that led them to Amerisave in the first place.

The company also required consumers to pay for an appraisal before it would provide a good-faith estimate; then it ordered the appraisal from an affiliated company. Borrowers weren't told that tiny fact until later.

Then, at closing, Amerisave charged its customers for something called "appraisal validation" reports without disclosing that the service was provided by an affiliated company. They also weren't told the fee was marked up by as much as 900%.

In its investigation, the CFPB found that Amerisave and its owner, Patrick Markert, pocketed more than $3 million in indirect profit distributions by overcharging unknowing borrowers. The validation reports cost $20, but Amerisave charged $100, with the $80 windfall finding its way to Markert's wallet.

First, the business bad guys, represented today by Amerisave Mortgage Corp., which the Consumer Financial Protection Bureau has ordered to pay $19.3 million for providing a deceptive bait-and-switch scheme on would-be borrowers.

The CFPB found that the Atlanta-based online company, which lends in all 50 states, lured consumers by advertising misleading interest rates. Then locked them in with costly up-front fees, failed to honor its published rates and illegally overcharged them for affiliated third-party services.

Here's how it worked, according to the CFPB:

Since 2011, the company advertised inaccurate rates and terms in online banner ads and searchable rate tables on third-party websites, inducing consumers to pursue a mortgage with Amerisave. Once at Amerisave's website, consumers received quotes based on an 800 FICO score, even when they had previously entered a score well below 800 on the third-party site that led them to Amerisave in the first place.

The company also required consumers to pay for an appraisal before it would provide a good-faith estimate; then it ordered the appraisal from an affiliated company. Borrowers weren't told that tiny fact until later.

Then, at closing, Amerisave charged its customers for something called "appraisal validation" reports without disclosing that the service was provided by an affiliated company. They also weren't told the fee was marked up by as much as 900%.

In its investigation, the CFPB found that Amerisave and its owner, Patrick Markert, pocketed more than $3 million in indirect profit distributions by overcharging unknowing borrowers. The validation reports cost $20, but Amerisave charged $100, with the $80 windfall finding its way to Markert's wallet.

Monday, September 1, 2014

Apple Settles E Book Fixed Pricing Suit!

Apple Inc. has agreed to pay up to $400 million to settle claims brought by 33 state attorneys general and private class action Plaintiffs that the company conspired to fix prices on e-books, bringing possible compensation for e-book purchasers up to $566 million. Apple agreed to pay $400 million to consumers, as well as $50 million in payments to the states and attorneys’ fees, if the lower court’s July 2013 liability ruling against the company is affirmed by the Second Circuit.

If the decision is remanded for reconsideration, Apple will pay $50 million to purchasers, along with $20 million in attorneys’ fees and state payments. But Apple will pay nothing if the lower court’s ruling is reversed. When combined with the $166 million already paid by publishers in earlier settlements, consumers stand to receive up to $566 million if the lower court’s liability judgment against Apple is upheld.

Subscribe to:

Posts (Atom)